25 Frugal Changes You Can Make Today

Here are some great tips for frugal living from wisebread. If you're not living frugally, you are leaving money on the table!

I shamelessly love money...cash, gold, silver...whatever I can get my paws on. And when I get it I'd like to keep it, thank you. This is my blog on money, frugality, getting out of debt, couponing, silver and gold, saving and investing. In these uncertain economic times I am educating myself on personal finance matters, getting out of debt, and taking the necessary steps to improve my financial situation.

Wednesday, March 30, 2011

Tuesday, March 22, 2011

You are invited: Watch my Autism Speaks video message

You are invited: Watch my Autism Speaks video message

Please join me in my fight to make a difference in the lives of the more than 1 million Americans living with autism today.

I am participating in Walk Now for Autism Speaks to help change the future for all those affected by autism, including my 17 year old son, Sean who has PDD-NOS, an autistic spectrum disorder.

Autism is the second most common developmental disorder in the United States affecting one in every 110 children born today. Despite some promising discoveries, the cause of autism is unknown and a cure does not exist. Research is crucial. Every 15 minutes another child is diagnosed with autism. Not only must we find ways to improve the quality of life for children and adults with autism, but we also must find a cure, and soon.

Walk Now for Autism Speaks is our chance to make a difference in the fight against autism by raising money for autism research and heightening public awareness. Please join me in my fight as I raise money to help fund essential research.

I know many organizations are asking for your help right now, particularly with the current situation in Japan. I understand and I'm giving to the Red Cross too. If you could donate something to sponsor me for the walk, I would greatly appreciate it. Autism affects my family 24/7 and I want to see a brighter future for people like my son Sean.

You can donate to Walk Now for Autism Speaks and/or join my team online using the link. Donations can also be mailed to Autism Speaks using the donation form located on my page or send me a check made out to Autism Speaks.

Thank you for taking an important step in the fight against autism.

Donations are tax deductible to the fullest extent allowed by law.

Autism Speaks 501 (C)(3) Tax Id #: 20-2329938

Please join me in my fight to make a difference in the lives of the more than 1 million Americans living with autism today.

I am participating in Walk Now for Autism Speaks to help change the future for all those affected by autism, including my 17 year old son, Sean who has PDD-NOS, an autistic spectrum disorder.

Autism is the second most common developmental disorder in the United States affecting one in every 110 children born today. Despite some promising discoveries, the cause of autism is unknown and a cure does not exist. Research is crucial. Every 15 minutes another child is diagnosed with autism. Not only must we find ways to improve the quality of life for children and adults with autism, but we also must find a cure, and soon.

Walk Now for Autism Speaks is our chance to make a difference in the fight against autism by raising money for autism research and heightening public awareness. Please join me in my fight as I raise money to help fund essential research.

I know many organizations are asking for your help right now, particularly with the current situation in Japan. I understand and I'm giving to the Red Cross too. If you could donate something to sponsor me for the walk, I would greatly appreciate it. Autism affects my family 24/7 and I want to see a brighter future for people like my son Sean.

You can donate to Walk Now for Autism Speaks and/or join my team online using the link. Donations can also be mailed to Autism Speaks using the donation form located on my page or send me a check made out to Autism Speaks.

Thank you for taking an important step in the fight against autism.

Donations are tax deductible to the fullest extent allowed by law.

Autism Speaks 501 (C)(3) Tax Id #: 20-2329938

Monday, March 14, 2011

Life Support inflation

Well, it happened again, my beloved big bag of 8 O'clock Colombian in the 40 oz bag (2.5 lbs) went up in price at Sam's Club. It seems like it was $11.65 last month and now it is $12.47 a bag. When I started watching this coffee price around the beginning of the year it was $11.22 a bag. This is like a 10% jump in the first quarter. I predict that it will be $15 by the end of 2011.

I know coffee is considered a commodity, but to some people... namely me ... it is life support. A bag this size only lasts a little over a week in my house. I expect food prices and other prices to increase about 10% this year. We are already seeing it with food and gas prices. Maybe its not hyperinflation, but its bad enough. As governments try to inflate away their debts, we pay for it.

Brace yourself.

I know coffee is considered a commodity, but to some people... namely me ... it is life support. A bag this size only lasts a little over a week in my house. I expect food prices and other prices to increase about 10% this year. We are already seeing it with food and gas prices. Maybe its not hyperinflation, but its bad enough. As governments try to inflate away their debts, we pay for it.

Brace yourself.

Sunday, March 13, 2011

Paid off the student loan - Kicked Aunt Sallie out!

After my divorce nearly 15 years ago I went back to college. I was working full time, struggling to get a diagnosis for my autistic son and just trying to get by as a single mom. It took me nearly six years to get an associates and then a bachelors degree. I graduated with honors close to ten years ago and yesterday I made my final payment of about $200 on my school loans and paid it off. WOOT!

I really thought I would have paid these loans off long ago. I borrowed roughly $6,000 and my payments were only about $50 a month. When you take out these loans in college, the expectation is that you will be a professional making booocooo bucks and repayment will be a breeze. Well, it's not. I was in deferment for over a year after a layoff and did not go into a high paying profession. I have a BFA.

Many students borrow ten times as much as I did and I don't know how on earth they can possibly make those $600 payments. Maybe its because I was an older student with more responsibilities and being house poor, etc. that made it such a struggle.... but at least I knew what I wanted to go for a degree in when I started. I pretty much needed to go back to school in order to work in the same field I did before mommy-tracking. Unfortunately, now many jobs like mine are going to India and I may need to return to school in my 50s for who knows what. I sure hope not.

Now my daughter is in her second year of college and has no debt thanks to going to junior college entirely on scholarships. She did not get a Pell grant this year, but was able to get a job at school and is trying to save up for next year when she will be going to an out of state university for her third and fourth year. The field she is going into is very small and requires a masters degree. She will be able to get the masters in state, thankfully. We've got the FAFSA in and some scholarship applications. Unfortunately, we won't know the results until about June. She will probably end up taking loans to get through school as I have no savings for that and her father is totally out of the picture.

I wish I could help her, but my limited funds are tied up in this house and my retirement fund. It is better for her to take responsibility for her own future and borrow for school as needed than for me to have to live on Alpo during my retirement. She's known for years that I will not take out loans for her college so has no expectations for me to pay for her college. I will send her care packages and money when I can though. She will always be my princess.

Yes, sometimes I feel a bit guilty because I can't give my kids what their friends have but then I get over it pretty quickly. My life is complicated and expensive. I live frugally, and I'm still broke. I am trying hard to save in my 401k my measly 529 for my son. I don't expect him to have the same scholarship opportunities as his sister, and he will most likely need vocational training after high school. Also, you can't borrow money to retire on and I won't be anywhere near saving the half million dollars I will need to retire on... I'm not even one-tenth of the way there and you can't borrow money for living expenses during retirement... and Kats don't eat Alpo!

The best I can hope for is that I pay off my home and avoid a mortgage when I'm retired and that my kids will both be self-supporting. Unfortunately, my son will probably always be dependent on me and his sister to some degree. We'll all make it through fine though, I'm sure.

I really thought I would have paid these loans off long ago. I borrowed roughly $6,000 and my payments were only about $50 a month. When you take out these loans in college, the expectation is that you will be a professional making booocooo bucks and repayment will be a breeze. Well, it's not. I was in deferment for over a year after a layoff and did not go into a high paying profession. I have a BFA.

Many students borrow ten times as much as I did and I don't know how on earth they can possibly make those $600 payments. Maybe its because I was an older student with more responsibilities and being house poor, etc. that made it such a struggle.... but at least I knew what I wanted to go for a degree in when I started. I pretty much needed to go back to school in order to work in the same field I did before mommy-tracking. Unfortunately, now many jobs like mine are going to India and I may need to return to school in my 50s for who knows what. I sure hope not.

Now my daughter is in her second year of college and has no debt thanks to going to junior college entirely on scholarships. She did not get a Pell grant this year, but was able to get a job at school and is trying to save up for next year when she will be going to an out of state university for her third and fourth year. The field she is going into is very small and requires a masters degree. She will be able to get the masters in state, thankfully. We've got the FAFSA in and some scholarship applications. Unfortunately, we won't know the results until about June. She will probably end up taking loans to get through school as I have no savings for that and her father is totally out of the picture.

I wish I could help her, but my limited funds are tied up in this house and my retirement fund. It is better for her to take responsibility for her own future and borrow for school as needed than for me to have to live on Alpo during my retirement. She's known for years that I will not take out loans for her college so has no expectations for me to pay for her college. I will send her care packages and money when I can though. She will always be my princess.

Yes, sometimes I feel a bit guilty because I can't give my kids what their friends have but then I get over it pretty quickly. My life is complicated and expensive. I live frugally, and I'm still broke. I am trying hard to save in my 401k my measly 529 for my son. I don't expect him to have the same scholarship opportunities as his sister, and he will most likely need vocational training after high school. Also, you can't borrow money to retire on and I won't be anywhere near saving the half million dollars I will need to retire on... I'm not even one-tenth of the way there and you can't borrow money for living expenses during retirement... and Kats don't eat Alpo!

The best I can hope for is that I pay off my home and avoid a mortgage when I'm retired and that my kids will both be self-supporting. Unfortunately, my son will probably always be dependent on me and his sister to some degree. We'll all make it through fine though, I'm sure.

Friday, March 11, 2011

Saving to Travel

Here's a nice post at Solo Friendly, a travel blog by Gray Cargill that I think is pretty cool. It puts saving into a different perspective. When you are saving for travel or fun stuff, make it a game rather than a chore or diet. I've been reading this blog for awhile and it helped me when I decided to take a solo trip to Vegas last year to see a bunch of Beatles shows.

"Do you wish you could travel more, but your paycheck seems to be gone at the end of every month? You’re not alone. Especially in the past couple of years, most of us consider ourselves lucky if we even have a job, let alone have seen a raise that has kept us even with the cost of inflation. If the only thing standing between you and more travel is money, then you’ll want to read on. Because if there’s one thing I’m good at, it’s the Saving Game." [read more]

"Do you wish you could travel more, but your paycheck seems to be gone at the end of every month? You’re not alone. Especially in the past couple of years, most of us consider ourselves lucky if we even have a job, let alone have seen a raise that has kept us even with the cost of inflation. If the only thing standing between you and more travel is money, then you’ll want to read on. Because if there’s one thing I’m good at, it’s the Saving Game." [read more]

Sunday, March 6, 2011

My 2010 Tax Refund

Woo hoo! I just got my tax refund. I know I should strive to owe nothing and not get a refund, but...whatever. It still feels like free money although I know it is not. I also realize that this may be my last four-figure refund as I expect to have less to deduct next year, my youngest will be over 17 and I plan to have my student loan paid off.

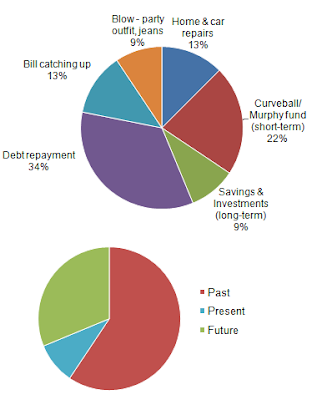

I planned carefully on paper where the refund money would go and then Murphy came for a visit and busted my car again, my kid ran up the cell phone bill and my department at work decided to have a big fancy party. This was a slight detour from paying off my school loan in full with the refund money and socking away more in my emergency fund, but it didn't totally derail me. I am so tired of paying for for my past and want to catch up and put more money toward the future. If you are wondering why I put more into my curve ball account instead of my longer term emergency fund, it is because the mechanic said the old car will need a brake job within two months.

Here's the the breakdown of where the money went. The first chart is where the money went to... and boy did it go fast! For the second pie chart, ideally, it should be allocated at least half to the future. Once my debts are gone, that should become a reality. OK, here's my pie charts showing where this windfall (a bit over a grand) went...

This year, for the first time, I opted to take part of my income tax refund in savings bonds. I had never noticed that option before and have never owned savings bonds. I didn't know how it worked or what the bonds were paying. I found out that it wasn't that easy to find out information on bonds quickly and before TurboTax timed out. I figured I will try it for fifty bucks just to check it out and it would force me to save at least $50 of the refund I had coming.

I just found this article online today that explains it better than what I read on the Treasury site. Read a little more about how this works at wisebread.com Receiving Your Tax Refund in Savings Bonds

I planned carefully on paper where the refund money would go and then Murphy came for a visit and busted my car again, my kid ran up the cell phone bill and my department at work decided to have a big fancy party. This was a slight detour from paying off my school loan in full with the refund money and socking away more in my emergency fund, but it didn't totally derail me. I am so tired of paying for for my past and want to catch up and put more money toward the future. If you are wondering why I put more into my curve ball account instead of my longer term emergency fund, it is because the mechanic said the old car will need a brake job within two months.

Here's the the breakdown of where the money went. The first chart is where the money went to... and boy did it go fast! For the second pie chart, ideally, it should be allocated at least half to the future. Once my debts are gone, that should become a reality. OK, here's my pie charts showing where this windfall (a bit over a grand) went...

This year, for the first time, I opted to take part of my income tax refund in savings bonds. I had never noticed that option before and have never owned savings bonds. I didn't know how it worked or what the bonds were paying. I found out that it wasn't that easy to find out information on bonds quickly and before TurboTax timed out. I figured I will try it for fifty bucks just to check it out and it would force me to save at least $50 of the refund I had coming.

I just found this article online today that explains it better than what I read on the Treasury site. Read a little more about how this works at wisebread.com Receiving Your Tax Refund in Savings Bonds

Subscribe to:

Posts (Atom)