Yesterday I called Bank of America to see whether it was worth my while to look at refinancing my current mortgage. I had refinanced a couple of years ago to a 5% mortgage and it seems like rates being advertised around have been around 4% for quite some time, but with closing costs and fees I wasn't sure it would be worth refinancing.

I was transferred to a guy and he said he would check it out. He put me on hold and said that my loan was more than my house was worth by about $6000 and 5% is a good rate and rates were actually more like 4.5% now. He also told me that if I refinanced my house and wanted to avoid a PMI payment, I would have to come up with $37,000 additional.... like another down payment to make my loan to value less than 80%! Un-freaking-believable!!

When I purchased my townhouse in 2002 I put down 15% and eliminated the PMI even before refinancing in mid 2009. I'm no idiot so I do know that home prices have gone down some, but there is no way this house is worth nearly $30,000 less than I paid for it nearly 10 years ago. My neighbors bought their unit a year or so ago for more than I paid, so I assumed we had a lost decade of real estate value and I'd just have to wait for the market to rebound in a couple of years. So much for rebounding.

Then I remembered that I had read or heard something about Bank of America and other big banks using their own appraisers who low-ball the appraisals and people weren't getting home loans. I think this is what is going on. Apparently, they purchased an appraisal company which they use exclusively and the BoA guy I talked to on the phone gave me a number almost instantly. After I was off the phone I checked Zillow and the value they had posted for my house was much more realistic (about $36,000 more than the estimate BoA had given me). That was a relief. I know I have very little, if any equity in my home at this point and will probably have to wait before selling or else I'll end up paying or short selling, which I certainly don't want to do.

I do like owning my own place and it would cost just as much to rent a 3 bedroom in my town or the northside of Chicago. As much as I don't want to spend another winter in Chicago, it looks like I'm going to have to. bbbrrrrrrrrrr

I shamelessly love money...cash, gold, silver...whatever I can get my paws on. And when I get it I'd like to keep it, thank you. This is my blog on money, frugality, getting out of debt, couponing, silver and gold, saving and investing. In these uncertain economic times I am educating myself on personal finance matters, getting out of debt, and taking the necessary steps to improve my financial situation.

Saturday, October 22, 2011

Thursday, August 4, 2011

The Spending-Cut Myth

Hot aired politicians have been blowing a lot of hot air recently about the debt ceiling. If they ran this country more like a business, or even a household for that matter, we would be in much better shape. Unfortunately, they spend like drunken congressmen trying to gain favors and votes. Budgeting is something that needs to be specific, not spineless like Robert Ringer's article says very well. Enjoy! ~kat

* * * * *

by Robert Ringer

As we move toward a business-as-usual finish to the phony debt-ceiling drama that has been playing out in Washington, history will record that not one of the key participants in the debate ever got around to talking about specific, major spending cuts (other than defense spending). Isn’t that weird?

Everyone who was involved claims to be in agreement that the U.S. has to cut spending, but not one person in a leadership role has been willing to name a specific program or bureaucracy that should be completely eliminated. Even if Republicans had gotten their cut, cap, and balance proposal accepted, it wouldn’t have mattered, because “cut, cap, and balance” are nothing more than hollow words.

Cut and cap what? Which programs and agencies are you going to cut and cap, and by how much? In any event, the purported major cuts are always years down the road, while increasing the debt ceiling is immediate — meaning that out-of-control government spending continues on.

And, of course, balance simply guarantees American taxpayers that if Congress doesn’t make the necessary cuts — which it never does, and never will — their taxes will be raised in order to “balance the budget.” In fact, a cynic might say that balancing the budget is just a euphemism for raising taxes.

Again, back to my original point: No one in a leadership role wants to talk about making specific cuts. After all, when you cut a program or agency, you’re going to make the beneficiaries of that program or agency very angry. And since the main objective of the vast majority of Congresspersons is to get reelected, mad is bad. Thus, the reality is that cutting any program or government agency is unthinkable.

For example, as the debt-ceiling circus has worn on, I’ve repeatedly heard media pundits say things like, “What happens to the guy who’s planned a camping trip to Yellowstone National Park with his son, only to find that the park has been closed because Congress failed to raise the debt ceiling?” The answer you never hear is: He takes his son somewhere else!

I don’t know how much you and I pay to keep Yellowstone National Park operating, but I do know that neither I nor any of my family or immediate circle of friends has ever visited Yellowstone National Park, nor do any of us have any plans to do so.

That being the case, why are we required to pay for the guy who wants to take his son camping? Is he willing to pay for my family’s outing to an Orioles or Redskins game? The latter are operated by private corporations that charge customers enough to cover their overhead and, hopefully, make a profit. But government doesn’t have to worry about such mundane matters.

Just like all the other land it lays claim to, the United States government should sell Yellowstone National Park to a company like Disney or Universal Studios and use the proceeds to pay down the national debt. I’m talking about principal, not interest. Ditto all of the other national parks, which would cut billions from our bread-and-circus budget.

Speaking of Yellowstone National Park, what about the Department of the Interior? Do we really need it? On its website, it proudly states:

Our Mission: Protecting America’s Great Outdoors and Powering Our Future

Question: Why does a bankrupt nation need a bunch of bureaucrats to protect its “great outdoors?” The government is supposed to protect people and private property, not the “outdoors.” I won’t even comment on “powering our future,” since it has no discernable meaning.

Beneath the Department of the Interior’s mission statement are the words:

The U.S. Department of the Interior protects America’s natural resources and heritage, honors our cultures and tribal communities, and supplies the energy to power our future.

Again I ask, why does a bankrupt nation need a bunch of bureaucrats to protect its “natural resources and heritage?” And how in the world does the government protect our heritage anyway? Again, no discernable meaning.

“Honors our cultures and tribal communities?” Why does a bankrupt nation need to honor American cultures and tribal communities? Sounds like an interesting thing to do if you’re rich. But we aren’t. Psst … we’re broke!

Finally, “supplies the energy to power our future?” Government doesn’t know beans about supplying energy. In fact, it does everything within its power to prevent the U.S. from exploiting its energy resources.

A bankrupt nation that fails at everything it attempts to do should get out of the way so private industry can tap our natural resources, beginning with oil, natural gas, and coal deposits. The government has never produced a drop of oil, a cubic foot of natural gas, or a single chunk of coal — and never will.

Trees, of course, are a natural resource that present no problem whatsoever, because, thanks to capitalistic forestry corporations, we have more trees today than we had fifty years ago.

You can go right down the list of government agencies and draw the same conclusion: They should all be shut down!

Do we really need a National Labor Relations Board to prevent Boeing from creating 1,000 jobs in South Carolina?

Do we really need a Securities and Exchange Commission to give a guy like Bernie Madoff a stamp of approval for twenty-five years while he bilks gullible investors out of billions of dollars?

Do we really need an Environmental Protection Agency to stifle economic growth in America and create ever-increasing unemployment? Closing down the EPA not only would save billions of dollars a year in operating costs, but would explode the economy and send the DJIA soaring. Who knows, we might even be able to compete with China some day.

The same goes for the Department of Labor, the Commerce Department, Amtrak, the Department of Education, the Department of Energy, the Department of Health and Human Services (which runs 400 separate subsidy programs!) … the list is endless.

Message to the government: Stop protecting our resources, stop redistributing our hard-earned income, and start focusing on protecting, not violating the liberty of, the people you work for.

The truth is that, with few exceptions, no one — whether Democrat or Republican — will propose legislation to reduce, let alone close down, any of these government agencies. They will keep growing until their employees are paid in worthless dollars — or not paid at all. And there is a 100 percent certainty that when government employees don’t get paid, it will lead to protests … followed by “civil unrest” … followed by violence … followed by a government crackdown on civil liberties. Madison, Wisconsin was a prelude of things to come.

As everyone now knows, the government has plenty of money coming in each month to pay interest on the national debt, Social Security, Medicare, and our current military obligations (all of which total about 70 percent of current revenues). It’s the other 30 percent or so of “scheduled expenditures” that need to be “prioritized” — meaning that some of them have to be cut.

But when you ask a politician which ones he would cut, he unfailingly skirts the question. That’s why the debt ceiling will continue to be raised — again and again and again (seventy-five times since 1962!) — and the U.S. debt will continue to spin out of control until the only thing left of the U.S. economy is a (hopefully) thriving black market.

Russian historians can tell you all about the robustness of the black market when the government shuts down the free market. It’s the only thing that kept even more people from starving to death in the Soviet Union during the heyday of communism.

Of course, if you’re the adventuresome type, you’ve got to be excited thinking about what living in an anything-goes, runaway-inflation society might be like. Hint: Sieg Heil!

You have permission to reprint this article so long as you place the following wording at the end of the article:

Copyright © 2011 Robert Ringer

ROBERT RINGER is the author of three #1 bestsellers and host of the highly acclaimed Liberty Education Interview Series, which features interviews with top political, economic, and social leaders. Ringer has appeared on numerous national talk shows and has been the subject of feature articles in such major publications as Time, People, The Wall Street Journal, Fortune, Barron's, and The New York Times.

To sign up for his one-of-a-kind, pro-liberty e-letter, A Voice of Sanity, visit: www.robertringer.com

* * * * *

by Robert Ringer

As we move toward a business-as-usual finish to the phony debt-ceiling drama that has been playing out in Washington, history will record that not one of the key participants in the debate ever got around to talking about specific, major spending cuts (other than defense spending). Isn’t that weird?

Everyone who was involved claims to be in agreement that the U.S. has to cut spending, but not one person in a leadership role has been willing to name a specific program or bureaucracy that should be completely eliminated. Even if Republicans had gotten their cut, cap, and balance proposal accepted, it wouldn’t have mattered, because “cut, cap, and balance” are nothing more than hollow words.

Cut and cap what? Which programs and agencies are you going to cut and cap, and by how much? In any event, the purported major cuts are always years down the road, while increasing the debt ceiling is immediate — meaning that out-of-control government spending continues on.

And, of course, balance simply guarantees American taxpayers that if Congress doesn’t make the necessary cuts — which it never does, and never will — their taxes will be raised in order to “balance the budget.” In fact, a cynic might say that balancing the budget is just a euphemism for raising taxes.

Again, back to my original point: No one in a leadership role wants to talk about making specific cuts. After all, when you cut a program or agency, you’re going to make the beneficiaries of that program or agency very angry. And since the main objective of the vast majority of Congresspersons is to get reelected, mad is bad. Thus, the reality is that cutting any program or government agency is unthinkable.

For example, as the debt-ceiling circus has worn on, I’ve repeatedly heard media pundits say things like, “What happens to the guy who’s planned a camping trip to Yellowstone National Park with his son, only to find that the park has been closed because Congress failed to raise the debt ceiling?” The answer you never hear is: He takes his son somewhere else!

I don’t know how much you and I pay to keep Yellowstone National Park operating, but I do know that neither I nor any of my family or immediate circle of friends has ever visited Yellowstone National Park, nor do any of us have any plans to do so.

That being the case, why are we required to pay for the guy who wants to take his son camping? Is he willing to pay for my family’s outing to an Orioles or Redskins game? The latter are operated by private corporations that charge customers enough to cover their overhead and, hopefully, make a profit. But government doesn’t have to worry about such mundane matters.

Just like all the other land it lays claim to, the United States government should sell Yellowstone National Park to a company like Disney or Universal Studios and use the proceeds to pay down the national debt. I’m talking about principal, not interest. Ditto all of the other national parks, which would cut billions from our bread-and-circus budget.

Speaking of Yellowstone National Park, what about the Department of the Interior? Do we really need it? On its website, it proudly states:

Our Mission: Protecting America’s Great Outdoors and Powering Our Future

Question: Why does a bankrupt nation need a bunch of bureaucrats to protect its “great outdoors?” The government is supposed to protect people and private property, not the “outdoors.” I won’t even comment on “powering our future,” since it has no discernable meaning.

Beneath the Department of the Interior’s mission statement are the words:

The U.S. Department of the Interior protects America’s natural resources and heritage, honors our cultures and tribal communities, and supplies the energy to power our future.

Again I ask, why does a bankrupt nation need a bunch of bureaucrats to protect its “natural resources and heritage?” And how in the world does the government protect our heritage anyway? Again, no discernable meaning.

“Honors our cultures and tribal communities?” Why does a bankrupt nation need to honor American cultures and tribal communities? Sounds like an interesting thing to do if you’re rich. But we aren’t. Psst … we’re broke!

Finally, “supplies the energy to power our future?” Government doesn’t know beans about supplying energy. In fact, it does everything within its power to prevent the U.S. from exploiting its energy resources.

A bankrupt nation that fails at everything it attempts to do should get out of the way so private industry can tap our natural resources, beginning with oil, natural gas, and coal deposits. The government has never produced a drop of oil, a cubic foot of natural gas, or a single chunk of coal — and never will.

Trees, of course, are a natural resource that present no problem whatsoever, because, thanks to capitalistic forestry corporations, we have more trees today than we had fifty years ago.

You can go right down the list of government agencies and draw the same conclusion: They should all be shut down!

Do we really need a National Labor Relations Board to prevent Boeing from creating 1,000 jobs in South Carolina?

Do we really need a Securities and Exchange Commission to give a guy like Bernie Madoff a stamp of approval for twenty-five years while he bilks gullible investors out of billions of dollars?

Do we really need an Environmental Protection Agency to stifle economic growth in America and create ever-increasing unemployment? Closing down the EPA not only would save billions of dollars a year in operating costs, but would explode the economy and send the DJIA soaring. Who knows, we might even be able to compete with China some day.

The same goes for the Department of Labor, the Commerce Department, Amtrak, the Department of Education, the Department of Energy, the Department of Health and Human Services (which runs 400 separate subsidy programs!) … the list is endless.

Message to the government: Stop protecting our resources, stop redistributing our hard-earned income, and start focusing on protecting, not violating the liberty of, the people you work for.

The truth is that, with few exceptions, no one — whether Democrat or Republican — will propose legislation to reduce, let alone close down, any of these government agencies. They will keep growing until their employees are paid in worthless dollars — or not paid at all. And there is a 100 percent certainty that when government employees don’t get paid, it will lead to protests … followed by “civil unrest” … followed by violence … followed by a government crackdown on civil liberties. Madison, Wisconsin was a prelude of things to come.

As everyone now knows, the government has plenty of money coming in each month to pay interest on the national debt, Social Security, Medicare, and our current military obligations (all of which total about 70 percent of current revenues). It’s the other 30 percent or so of “scheduled expenditures” that need to be “prioritized” — meaning that some of them have to be cut.

But when you ask a politician which ones he would cut, he unfailingly skirts the question. That’s why the debt ceiling will continue to be raised — again and again and again (seventy-five times since 1962!) — and the U.S. debt will continue to spin out of control until the only thing left of the U.S. economy is a (hopefully) thriving black market.

Russian historians can tell you all about the robustness of the black market when the government shuts down the free market. It’s the only thing that kept even more people from starving to death in the Soviet Union during the heyday of communism.

Of course, if you’re the adventuresome type, you’ve got to be excited thinking about what living in an anything-goes, runaway-inflation society might be like. Hint: Sieg Heil!

You have permission to reprint this article so long as you place the following wording at the end of the article:

Copyright © 2011 Robert Ringer

ROBERT RINGER is the author of three #1 bestsellers and host of the highly acclaimed Liberty Education Interview Series, which features interviews with top political, economic, and social leaders. Ringer has appeared on numerous national talk shows and has been the subject of feature articles in such major publications as Time, People, The Wall Street Journal, Fortune, Barron's, and The New York Times.

To sign up for his one-of-a-kind, pro-liberty e-letter, A Voice of Sanity, visit: www.robertringer.com

Saturday, July 30, 2011

Making Your Own Homemade Oatmeal Packets: A Visual Guide and Cost Analysis

by Trent Hamm - The Simple Dollar

The Basic Recipe

All you really need to make your own basic oatmeal packets at home are instant (ready to eat in one minute) oatmeal, salt, and sealable baggies to store them in – you might also want sugar or another sweetener if you wish to pre-sweeten the oatmeal.

Core ingredients

The procedure is really easy. Just add 1/4 of a cup of the oats and a pinch of salt (1/8 of a teaspoon if you must measure it) to each baggie. Out of that container there, you’d get about 48 bags. I also like to pre-add a bit of sugar to it – about 1/2 of a teaspoon. You can choose to add none at all or add another sweetener like Splenda at your own discretion.

These will result in basic oatmeal packets very similar to the “regular” oatmeal packets sold by Quaker Oats. If you like the basic oatmeal with no changes, this is a very cheap route to go – since you can re-use the baggies, the only recurring cost over a realistic timeframe is the oatmeal itself – a bag of sugar and a canister of salt will last you effectively forever with this recipe.

Flavoring It Up

Of course, I like to flavor it up.

On the left are the ingredients for cinnamon-raisin packets. On the right are ingredients for blueberries & cream packets – dried blueberries and fat-free non-dairy creamer. Why not powdered milk? It tends to potentially mold and have other bad effects if left in baggies for too long – Coffee Mate is an excellent substitute.

For my cinnamon-raisin packets, I just add about 1/4 of a teaspoon of cinnamon and about two dozen raisins to each bag. For the blueberry packets, I add a tablespoon of the creamer and about a dozen and a half blueberries. Perfect.

The nice part is you can basically make anything you want if you’re making your own packets. You can experiment as your heart desires – any dried fruit pieces, any seasonings you can find – anything. I’ve actually made batches of cranberry oatmeal using dried cranberries in the past – I love it, but it’s not something you see sold on store shelves.

Adding the ingredients yourself make for tastier packets. The pre-mixed packets that Quaker sells seem to use low-quality versions of the added ingredients. For example, the dried blueberries in this packet are way better than the blueberries used in the Quaker Oats packets, resulting in a much tastier blueberry oatmeal.

Storing the packets is easy, too. Just stuff the baggies into the oat canister. That’ll hold 80% of the baggies – just sit the rest next to them and eat those first. Problem solved.

I Like It Thicker

One thing I don’t like about the Quaker Oats packet in the stores is that the oatmeal is almost always too thin. Personally, I like thick oatmeal, the kind that reminds me of the stuff my great grandma used to make at her house.

Since you’re making your own baggies, you can make it nice and thick, too. All you have to do is puree some of the dry oatmeal in your handy-dandy blender.

Put in about a quarter of a cup at a time and put it on puree for about ten seconds. You end up with oatmeal powder.

Then, just add a tablespoon of this powder to each baggie to make it thicker. I actually add two tablespoons to each baggie – that makes it really, really thick – just how I like it!

I just dumped the baggie into the bowl (saving the baggie for reuse, of course), added about a quarter of a cup of skim milk, and microwaved it for about sixty seconds. Nice and thick and warm and delicious.

Cost Analysis

I wound up making 42 baggies with this batch. Normally, one would make 48 baggies out of a normal-sized canister of instant oatmeal, but I pureed enough of the oatmeal to make only 42.

15 of the baggies were blueberries and cream and 27 were cinnamon-raisin.

Unsurprisingly, there were a lot of ingredients left over:

I used all of the oatmeal and all of the blueberries, but I still had almost a full container of salt, an almost full container of cinnamon, an almost full container of sugar, a 2/3 full container of Coffee Mate, half a box of raisins, and 58 Glad baggies.

This means that if I were to make a second batch, I’d only need to replace the oatmeal and the blueberries. Since I can reuse the baggies and I have enough salt and sugar to last effectively forever, those are sunk startup costs – after that, you just need to replace oatmeal and the flavorings when you need to – and most of the flavorings will last for multiple batches.

Batch 1 – More Expensive

Of course, the first batch was a bit more expensive per packet than just buying the Quaker Oats packet. Here’s my receipt from Fareway for the stuff for 42 homemade packets:

The cost

The cost per homemade packet during the first run is $0.46 per packet. The cost would have been $0.43 per packet had I not ground up some of the packets to thicken some of the others. We’ll figure up costs for future runs in a minute.

What about the time cost? It took me about thirty minutes of mindless work to make these packets. I spent the entire time making them on the phone with my mother – I just conversed with her while my hands were busy with… well, busywork. Thus, I don’t consider the time sink to be significant.

How about the Quaker Oats packet? To control for location and store differences, I bought a box of packets at Fareway to compare the price:

A box of Quaker Oats packets?

The cost per packet for Quaker Oats is $0.30 per packet. Yep, the prepackaged ones are cheaper at first. But let’s keep looking.

Batch 2 and Future Batches – Less Expensive

The kicker with making your own packets is that they get cheaper on future runs. You don’t have to buy the sugar, the salt, or the baggies any more. Let’s say I made another identical batch to the one above – 42 packets. Using what I have on hand, I only have to repurchase the oats – $2.99 – and the blueberries – $3.29. The second homemade batch has a cost per packet of $0.15 – way cheaper than the prepared packets. In fact, averaging the two costs ends up with an average cost per homemade packet after two runs being almost identical to the cost of buying prepared packets – $0.30. If I had not ground up some of the oatmeal to make thicker packets, it would have been cheaper – $0.28 per packet.

Runs beyond the second further reduce the cost. And when you consider the flexibility of your homemade packets – and the fact that they taste far better – it becomes a pretty clear bargain after a while.

Reducing the Costs

Even more important, I didn’t optimize my ingredient purchases very well. A bit of optimization shaves off a lot of the cost.

The biggest way to save more money is to buy a giant canister of the oatmeal rather than a fairly small canister. Buying the oatmeal in bulk cuts down on the cost per packet significantly. Similar logic applies to some of the ingredients – if you particularly like blueberries in your oatmeal, for instance, buying them in bulk cuts down on costs, too.

Also, re-use the baggies. There’s no reason not to here – you’re only storing dry ingredients in them. Use them again.

Another tip – buy snack-sized baggies instead of sandwich baggies. I bought sandwich baggies in the example above because the store’s baggie selection was small – snack baggies are cheaper, easier to store, and hold an oatmeal packet easily.

All of these tips can trim the cost significantly, particularly on future batches.

Conclusion

If you or your family eat a lot of oatmeal, making your own packets is a cost-saver over the long haul – plus they make for tastier packets. In our house, I eat oatmeal four to five times a week, plus my son eats it twice a week and my wife perhaps once a week. That makes eight packets a week. In ten weeks, homemade packets become cheaper per packet. In twenty weeks, we’re now saving, on average, a dime for every packet we’ve eaten – $16. After that, it’s just gravy – another $1 or so each week saved while eating better oatmeal packets.

The key, though, is that your family eats a lot of oatmeal. If they don’t, then making your own packets probably won’t be cost-effective for you.

The Basic Recipe

All you really need to make your own basic oatmeal packets at home are instant (ready to eat in one minute) oatmeal, salt, and sealable baggies to store them in – you might also want sugar or another sweetener if you wish to pre-sweeten the oatmeal.

Core ingredients

The procedure is really easy. Just add 1/4 of a cup of the oats and a pinch of salt (1/8 of a teaspoon if you must measure it) to each baggie. Out of that container there, you’d get about 48 bags. I also like to pre-add a bit of sugar to it – about 1/2 of a teaspoon. You can choose to add none at all or add another sweetener like Splenda at your own discretion.

These will result in basic oatmeal packets very similar to the “regular” oatmeal packets sold by Quaker Oats. If you like the basic oatmeal with no changes, this is a very cheap route to go – since you can re-use the baggies, the only recurring cost over a realistic timeframe is the oatmeal itself – a bag of sugar and a canister of salt will last you effectively forever with this recipe.

Flavoring It Up

Of course, I like to flavor it up.

On the left are the ingredients for cinnamon-raisin packets. On the right are ingredients for blueberries & cream packets – dried blueberries and fat-free non-dairy creamer. Why not powdered milk? It tends to potentially mold and have other bad effects if left in baggies for too long – Coffee Mate is an excellent substitute.

For my cinnamon-raisin packets, I just add about 1/4 of a teaspoon of cinnamon and about two dozen raisins to each bag. For the blueberry packets, I add a tablespoon of the creamer and about a dozen and a half blueberries. Perfect.

The nice part is you can basically make anything you want if you’re making your own packets. You can experiment as your heart desires – any dried fruit pieces, any seasonings you can find – anything. I’ve actually made batches of cranberry oatmeal using dried cranberries in the past – I love it, but it’s not something you see sold on store shelves.

Adding the ingredients yourself make for tastier packets. The pre-mixed packets that Quaker sells seem to use low-quality versions of the added ingredients. For example, the dried blueberries in this packet are way better than the blueberries used in the Quaker Oats packets, resulting in a much tastier blueberry oatmeal.

Storing the packets is easy, too. Just stuff the baggies into the oat canister. That’ll hold 80% of the baggies – just sit the rest next to them and eat those first. Problem solved.

I Like It Thicker

One thing I don’t like about the Quaker Oats packet in the stores is that the oatmeal is almost always too thin. Personally, I like thick oatmeal, the kind that reminds me of the stuff my great grandma used to make at her house.

Since you’re making your own baggies, you can make it nice and thick, too. All you have to do is puree some of the dry oatmeal in your handy-dandy blender.

Put in about a quarter of a cup at a time and put it on puree for about ten seconds. You end up with oatmeal powder.

Then, just add a tablespoon of this powder to each baggie to make it thicker. I actually add two tablespoons to each baggie – that makes it really, really thick – just how I like it!

I just dumped the baggie into the bowl (saving the baggie for reuse, of course), added about a quarter of a cup of skim milk, and microwaved it for about sixty seconds. Nice and thick and warm and delicious.

Cost Analysis

I wound up making 42 baggies with this batch. Normally, one would make 48 baggies out of a normal-sized canister of instant oatmeal, but I pureed enough of the oatmeal to make only 42.

15 of the baggies were blueberries and cream and 27 were cinnamon-raisin.

Unsurprisingly, there were a lot of ingredients left over:

I used all of the oatmeal and all of the blueberries, but I still had almost a full container of salt, an almost full container of cinnamon, an almost full container of sugar, a 2/3 full container of Coffee Mate, half a box of raisins, and 58 Glad baggies.

This means that if I were to make a second batch, I’d only need to replace the oatmeal and the blueberries. Since I can reuse the baggies and I have enough salt and sugar to last effectively forever, those are sunk startup costs – after that, you just need to replace oatmeal and the flavorings when you need to – and most of the flavorings will last for multiple batches.

Batch 1 – More Expensive

Of course, the first batch was a bit more expensive per packet than just buying the Quaker Oats packet. Here’s my receipt from Fareway for the stuff for 42 homemade packets:

The cost

The cost per homemade packet during the first run is $0.46 per packet. The cost would have been $0.43 per packet had I not ground up some of the packets to thicken some of the others. We’ll figure up costs for future runs in a minute.

What about the time cost? It took me about thirty minutes of mindless work to make these packets. I spent the entire time making them on the phone with my mother – I just conversed with her while my hands were busy with… well, busywork. Thus, I don’t consider the time sink to be significant.

How about the Quaker Oats packet? To control for location and store differences, I bought a box of packets at Fareway to compare the price:

A box of Quaker Oats packets?

The cost per packet for Quaker Oats is $0.30 per packet. Yep, the prepackaged ones are cheaper at first. But let’s keep looking.

Batch 2 and Future Batches – Less Expensive

The kicker with making your own packets is that they get cheaper on future runs. You don’t have to buy the sugar, the salt, or the baggies any more. Let’s say I made another identical batch to the one above – 42 packets. Using what I have on hand, I only have to repurchase the oats – $2.99 – and the blueberries – $3.29. The second homemade batch has a cost per packet of $0.15 – way cheaper than the prepared packets. In fact, averaging the two costs ends up with an average cost per homemade packet after two runs being almost identical to the cost of buying prepared packets – $0.30. If I had not ground up some of the oatmeal to make thicker packets, it would have been cheaper – $0.28 per packet.

Runs beyond the second further reduce the cost. And when you consider the flexibility of your homemade packets – and the fact that they taste far better – it becomes a pretty clear bargain after a while.

Reducing the Costs

Even more important, I didn’t optimize my ingredient purchases very well. A bit of optimization shaves off a lot of the cost.

The biggest way to save more money is to buy a giant canister of the oatmeal rather than a fairly small canister. Buying the oatmeal in bulk cuts down on the cost per packet significantly. Similar logic applies to some of the ingredients – if you particularly like blueberries in your oatmeal, for instance, buying them in bulk cuts down on costs, too.

Also, re-use the baggies. There’s no reason not to here – you’re only storing dry ingredients in them. Use them again.

Another tip – buy snack-sized baggies instead of sandwich baggies. I bought sandwich baggies in the example above because the store’s baggie selection was small – snack baggies are cheaper, easier to store, and hold an oatmeal packet easily.

All of these tips can trim the cost significantly, particularly on future batches.

Conclusion

If you or your family eat a lot of oatmeal, making your own packets is a cost-saver over the long haul – plus they make for tastier packets. In our house, I eat oatmeal four to five times a week, plus my son eats it twice a week and my wife perhaps once a week. That makes eight packets a week. In ten weeks, homemade packets become cheaper per packet. In twenty weeks, we’re now saving, on average, a dime for every packet we’ve eaten – $16. After that, it’s just gravy – another $1 or so each week saved while eating better oatmeal packets.

The key, though, is that your family eats a lot of oatmeal. If they don’t, then making your own packets probably won’t be cost-effective for you.

Sunday, July 24, 2011

Making homemade laundry Detergent

Here is a laundry detergent recipe to try. http://www.livingonadime.com/homemade-laundry-detergent-2/

See more laundry detergent recipes here: You will need Fels Naptha bar soap, borax and washing soda for most recipes.

See more laundry detergent recipes here: You will need Fels Naptha bar soap, borax and washing soda for most recipes.

Sunday, April 17, 2011

50 Ways Retirees Can Cut Their Investment, Insurance, and Banking Costs

50 Ways Retirees Can Cut Their Investment, Insurance, and Banking Costs

Taking a closer look at fees and expenses that can add up to a lot if you're not watching.

Taking a closer look at fees and expenses that can add up to a lot if you're not watching.

Wednesday, March 30, 2011

25 Frugal Changes You Can Make Today

25 Frugal Changes You Can Make Today

Here are some great tips for frugal living from wisebread. If you're not living frugally, you are leaving money on the table!

Here are some great tips for frugal living from wisebread. If you're not living frugally, you are leaving money on the table!

Tuesday, March 22, 2011

You are invited: Watch my Autism Speaks video message

You are invited: Watch my Autism Speaks video message

Please join me in my fight to make a difference in the lives of the more than 1 million Americans living with autism today.

I am participating in Walk Now for Autism Speaks to help change the future for all those affected by autism, including my 17 year old son, Sean who has PDD-NOS, an autistic spectrum disorder.

Autism is the second most common developmental disorder in the United States affecting one in every 110 children born today. Despite some promising discoveries, the cause of autism is unknown and a cure does not exist. Research is crucial. Every 15 minutes another child is diagnosed with autism. Not only must we find ways to improve the quality of life for children and adults with autism, but we also must find a cure, and soon.

Walk Now for Autism Speaks is our chance to make a difference in the fight against autism by raising money for autism research and heightening public awareness. Please join me in my fight as I raise money to help fund essential research.

I know many organizations are asking for your help right now, particularly with the current situation in Japan. I understand and I'm giving to the Red Cross too. If you could donate something to sponsor me for the walk, I would greatly appreciate it. Autism affects my family 24/7 and I want to see a brighter future for people like my son Sean.

You can donate to Walk Now for Autism Speaks and/or join my team online using the link. Donations can also be mailed to Autism Speaks using the donation form located on my page or send me a check made out to Autism Speaks.

Thank you for taking an important step in the fight against autism.

Donations are tax deductible to the fullest extent allowed by law.

Autism Speaks 501 (C)(3) Tax Id #: 20-2329938

Please join me in my fight to make a difference in the lives of the more than 1 million Americans living with autism today.

I am participating in Walk Now for Autism Speaks to help change the future for all those affected by autism, including my 17 year old son, Sean who has PDD-NOS, an autistic spectrum disorder.

Autism is the second most common developmental disorder in the United States affecting one in every 110 children born today. Despite some promising discoveries, the cause of autism is unknown and a cure does not exist. Research is crucial. Every 15 minutes another child is diagnosed with autism. Not only must we find ways to improve the quality of life for children and adults with autism, but we also must find a cure, and soon.

Walk Now for Autism Speaks is our chance to make a difference in the fight against autism by raising money for autism research and heightening public awareness. Please join me in my fight as I raise money to help fund essential research.

I know many organizations are asking for your help right now, particularly with the current situation in Japan. I understand and I'm giving to the Red Cross too. If you could donate something to sponsor me for the walk, I would greatly appreciate it. Autism affects my family 24/7 and I want to see a brighter future for people like my son Sean.

You can donate to Walk Now for Autism Speaks and/or join my team online using the link. Donations can also be mailed to Autism Speaks using the donation form located on my page or send me a check made out to Autism Speaks.

Thank you for taking an important step in the fight against autism.

Donations are tax deductible to the fullest extent allowed by law.

Autism Speaks 501 (C)(3) Tax Id #: 20-2329938

Monday, March 14, 2011

Life Support inflation

Well, it happened again, my beloved big bag of 8 O'clock Colombian in the 40 oz bag (2.5 lbs) went up in price at Sam's Club. It seems like it was $11.65 last month and now it is $12.47 a bag. When I started watching this coffee price around the beginning of the year it was $11.22 a bag. This is like a 10% jump in the first quarter. I predict that it will be $15 by the end of 2011.

I know coffee is considered a commodity, but to some people... namely me ... it is life support. A bag this size only lasts a little over a week in my house. I expect food prices and other prices to increase about 10% this year. We are already seeing it with food and gas prices. Maybe its not hyperinflation, but its bad enough. As governments try to inflate away their debts, we pay for it.

Brace yourself.

I know coffee is considered a commodity, but to some people... namely me ... it is life support. A bag this size only lasts a little over a week in my house. I expect food prices and other prices to increase about 10% this year. We are already seeing it with food and gas prices. Maybe its not hyperinflation, but its bad enough. As governments try to inflate away their debts, we pay for it.

Brace yourself.

Sunday, March 13, 2011

Paid off the student loan - Kicked Aunt Sallie out!

After my divorce nearly 15 years ago I went back to college. I was working full time, struggling to get a diagnosis for my autistic son and just trying to get by as a single mom. It took me nearly six years to get an associates and then a bachelors degree. I graduated with honors close to ten years ago and yesterday I made my final payment of about $200 on my school loans and paid it off. WOOT!

I really thought I would have paid these loans off long ago. I borrowed roughly $6,000 and my payments were only about $50 a month. When you take out these loans in college, the expectation is that you will be a professional making booocooo bucks and repayment will be a breeze. Well, it's not. I was in deferment for over a year after a layoff and did not go into a high paying profession. I have a BFA.

Many students borrow ten times as much as I did and I don't know how on earth they can possibly make those $600 payments. Maybe its because I was an older student with more responsibilities and being house poor, etc. that made it such a struggle.... but at least I knew what I wanted to go for a degree in when I started. I pretty much needed to go back to school in order to work in the same field I did before mommy-tracking. Unfortunately, now many jobs like mine are going to India and I may need to return to school in my 50s for who knows what. I sure hope not.

Now my daughter is in her second year of college and has no debt thanks to going to junior college entirely on scholarships. She did not get a Pell grant this year, but was able to get a job at school and is trying to save up for next year when she will be going to an out of state university for her third and fourth year. The field she is going into is very small and requires a masters degree. She will be able to get the masters in state, thankfully. We've got the FAFSA in and some scholarship applications. Unfortunately, we won't know the results until about June. She will probably end up taking loans to get through school as I have no savings for that and her father is totally out of the picture.

I wish I could help her, but my limited funds are tied up in this house and my retirement fund. It is better for her to take responsibility for her own future and borrow for school as needed than for me to have to live on Alpo during my retirement. She's known for years that I will not take out loans for her college so has no expectations for me to pay for her college. I will send her care packages and money when I can though. She will always be my princess.

Yes, sometimes I feel a bit guilty because I can't give my kids what their friends have but then I get over it pretty quickly. My life is complicated and expensive. I live frugally, and I'm still broke. I am trying hard to save in my 401k my measly 529 for my son. I don't expect him to have the same scholarship opportunities as his sister, and he will most likely need vocational training after high school. Also, you can't borrow money to retire on and I won't be anywhere near saving the half million dollars I will need to retire on... I'm not even one-tenth of the way there and you can't borrow money for living expenses during retirement... and Kats don't eat Alpo!

The best I can hope for is that I pay off my home and avoid a mortgage when I'm retired and that my kids will both be self-supporting. Unfortunately, my son will probably always be dependent on me and his sister to some degree. We'll all make it through fine though, I'm sure.

I really thought I would have paid these loans off long ago. I borrowed roughly $6,000 and my payments were only about $50 a month. When you take out these loans in college, the expectation is that you will be a professional making booocooo bucks and repayment will be a breeze. Well, it's not. I was in deferment for over a year after a layoff and did not go into a high paying profession. I have a BFA.

Many students borrow ten times as much as I did and I don't know how on earth they can possibly make those $600 payments. Maybe its because I was an older student with more responsibilities and being house poor, etc. that made it such a struggle.... but at least I knew what I wanted to go for a degree in when I started. I pretty much needed to go back to school in order to work in the same field I did before mommy-tracking. Unfortunately, now many jobs like mine are going to India and I may need to return to school in my 50s for who knows what. I sure hope not.

Now my daughter is in her second year of college and has no debt thanks to going to junior college entirely on scholarships. She did not get a Pell grant this year, but was able to get a job at school and is trying to save up for next year when she will be going to an out of state university for her third and fourth year. The field she is going into is very small and requires a masters degree. She will be able to get the masters in state, thankfully. We've got the FAFSA in and some scholarship applications. Unfortunately, we won't know the results until about June. She will probably end up taking loans to get through school as I have no savings for that and her father is totally out of the picture.

I wish I could help her, but my limited funds are tied up in this house and my retirement fund. It is better for her to take responsibility for her own future and borrow for school as needed than for me to have to live on Alpo during my retirement. She's known for years that I will not take out loans for her college so has no expectations for me to pay for her college. I will send her care packages and money when I can though. She will always be my princess.

Yes, sometimes I feel a bit guilty because I can't give my kids what their friends have but then I get over it pretty quickly. My life is complicated and expensive. I live frugally, and I'm still broke. I am trying hard to save in my 401k my measly 529 for my son. I don't expect him to have the same scholarship opportunities as his sister, and he will most likely need vocational training after high school. Also, you can't borrow money to retire on and I won't be anywhere near saving the half million dollars I will need to retire on... I'm not even one-tenth of the way there and you can't borrow money for living expenses during retirement... and Kats don't eat Alpo!

The best I can hope for is that I pay off my home and avoid a mortgage when I'm retired and that my kids will both be self-supporting. Unfortunately, my son will probably always be dependent on me and his sister to some degree. We'll all make it through fine though, I'm sure.

Friday, March 11, 2011

Saving to Travel

Here's a nice post at Solo Friendly, a travel blog by Gray Cargill that I think is pretty cool. It puts saving into a different perspective. When you are saving for travel or fun stuff, make it a game rather than a chore or diet. I've been reading this blog for awhile and it helped me when I decided to take a solo trip to Vegas last year to see a bunch of Beatles shows.

"Do you wish you could travel more, but your paycheck seems to be gone at the end of every month? You’re not alone. Especially in the past couple of years, most of us consider ourselves lucky if we even have a job, let alone have seen a raise that has kept us even with the cost of inflation. If the only thing standing between you and more travel is money, then you’ll want to read on. Because if there’s one thing I’m good at, it’s the Saving Game." [read more]

"Do you wish you could travel more, but your paycheck seems to be gone at the end of every month? You’re not alone. Especially in the past couple of years, most of us consider ourselves lucky if we even have a job, let alone have seen a raise that has kept us even with the cost of inflation. If the only thing standing between you and more travel is money, then you’ll want to read on. Because if there’s one thing I’m good at, it’s the Saving Game." [read more]

Sunday, March 6, 2011

My 2010 Tax Refund

Woo hoo! I just got my tax refund. I know I should strive to owe nothing and not get a refund, but...whatever. It still feels like free money although I know it is not. I also realize that this may be my last four-figure refund as I expect to have less to deduct next year, my youngest will be over 17 and I plan to have my student loan paid off.

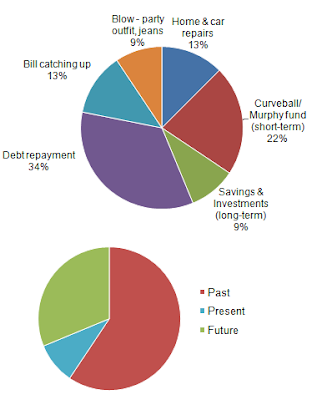

I planned carefully on paper where the refund money would go and then Murphy came for a visit and busted my car again, my kid ran up the cell phone bill and my department at work decided to have a big fancy party. This was a slight detour from paying off my school loan in full with the refund money and socking away more in my emergency fund, but it didn't totally derail me. I am so tired of paying for for my past and want to catch up and put more money toward the future. If you are wondering why I put more into my curve ball account instead of my longer term emergency fund, it is because the mechanic said the old car will need a brake job within two months.

Here's the the breakdown of where the money went. The first chart is where the money went to... and boy did it go fast! For the second pie chart, ideally, it should be allocated at least half to the future. Once my debts are gone, that should become a reality. OK, here's my pie charts showing where this windfall (a bit over a grand) went...

This year, for the first time, I opted to take part of my income tax refund in savings bonds. I had never noticed that option before and have never owned savings bonds. I didn't know how it worked or what the bonds were paying. I found out that it wasn't that easy to find out information on bonds quickly and before TurboTax timed out. I figured I will try it for fifty bucks just to check it out and it would force me to save at least $50 of the refund I had coming.

I just found this article online today that explains it better than what I read on the Treasury site. Read a little more about how this works at wisebread.com Receiving Your Tax Refund in Savings Bonds

I planned carefully on paper where the refund money would go and then Murphy came for a visit and busted my car again, my kid ran up the cell phone bill and my department at work decided to have a big fancy party. This was a slight detour from paying off my school loan in full with the refund money and socking away more in my emergency fund, but it didn't totally derail me. I am so tired of paying for for my past and want to catch up and put more money toward the future. If you are wondering why I put more into my curve ball account instead of my longer term emergency fund, it is because the mechanic said the old car will need a brake job within two months.

Here's the the breakdown of where the money went. The first chart is where the money went to... and boy did it go fast! For the second pie chart, ideally, it should be allocated at least half to the future. Once my debts are gone, that should become a reality. OK, here's my pie charts showing where this windfall (a bit over a grand) went...

This year, for the first time, I opted to take part of my income tax refund in savings bonds. I had never noticed that option before and have never owned savings bonds. I didn't know how it worked or what the bonds were paying. I found out that it wasn't that easy to find out information on bonds quickly and before TurboTax timed out. I figured I will try it for fifty bucks just to check it out and it would force me to save at least $50 of the refund I had coming.

I just found this article online today that explains it better than what I read on the Treasury site. Read a little more about how this works at wisebread.com Receiving Your Tax Refund in Savings Bonds

Labels:

debt repayment,

planned spending,

savings bonds,

tax refund

Monday, February 21, 2011

Home Salon Savings

I was supposed to get a haircut and color a couple of weeks ago but injured my back when I slipped on some ice and didn't reschedule my appointment. I was looking (and feeling) pretty ragged, but didn't want to spend $80 to $100 for a cut and color at this point and my daughter needed her hair done too. That would double the cost so we decided to do it at home this time around.

Both of us have long naturally mousy brown hair, mine is over 50% gray and my college aged daughter looks great as a redhead. Yesterday I did one of my couponing trips to the local Dominicks store and got nearly $200 worth of stuff for $106.77. Of course there were hair color coupons in there. I picked up Garnier for me because it was cheap and Feria for the girl because of the color (and coupon).

We broke out the old red towels, 2 timers and put on old t-shirts and got busy. This was actually the first time we did this together. Occasionally, I would dye her hair or she would do mine, but never both at the same day... with dinner cooking, too.

It actually worked out perfectly. We started with mine because of the gray it had to cook longer. While mine was "cooking" I started hers. Thank goodness for 2 timers. I don't know if I could stay on top without those. Talk about a bloodbath... when I finally rinsed her hair in the bathtub with the shower wand, it was like something out of a horror movie and looked like blood in the bathtub and she commented that maybe when she has her own place she'll do a psycho themed bath. That's my little spook!

After we were all rinsed and conditioned the haircuts began. Neither one of us are expert cutters and just cut an inch or two from the bottom and did a bangs trim. It worked out fine and we both have a basic long hair with bangs haircut. My hair was very stringy from the last kid at the salon who layered it all funky and I was happy to have some of that taken off. I still have some of the layering but its not all stringy like the step-child anymore. It really aggravates me that haircuts are so expensive, even at the so-called discount places like Haircuttery and everyone is so inexperienced. Ideally, I would want my hair done by someone over 35 and for about $50 for cut and color, but that ain't happening in the area where I live.

Now we look and feel so much better and saved about $200 ($300 if you count groceries savings that day). Just as we were finishing the stove timer went off. Dinnertime... and not a moment too soon.

Both of us have long naturally mousy brown hair, mine is over 50% gray and my college aged daughter looks great as a redhead. Yesterday I did one of my couponing trips to the local Dominicks store and got nearly $200 worth of stuff for $106.77. Of course there were hair color coupons in there. I picked up Garnier for me because it was cheap and Feria for the girl because of the color (and coupon).

We broke out the old red towels, 2 timers and put on old t-shirts and got busy. This was actually the first time we did this together. Occasionally, I would dye her hair or she would do mine, but never both at the same day... with dinner cooking, too.

It actually worked out perfectly. We started with mine because of the gray it had to cook longer. While mine was "cooking" I started hers. Thank goodness for 2 timers. I don't know if I could stay on top without those. Talk about a bloodbath... when I finally rinsed her hair in the bathtub with the shower wand, it was like something out of a horror movie and looked like blood in the bathtub and she commented that maybe when she has her own place she'll do a psycho themed bath. That's my little spook!

After we were all rinsed and conditioned the haircuts began. Neither one of us are expert cutters and just cut an inch or two from the bottom and did a bangs trim. It worked out fine and we both have a basic long hair with bangs haircut. My hair was very stringy from the last kid at the salon who layered it all funky and I was happy to have some of that taken off. I still have some of the layering but its not all stringy like the step-child anymore. It really aggravates me that haircuts are so expensive, even at the so-called discount places like Haircuttery and everyone is so inexperienced. Ideally, I would want my hair done by someone over 35 and for about $50 for cut and color, but that ain't happening in the area where I live.

Now we look and feel so much better and saved about $200 ($300 if you count groceries savings that day). Just as we were finishing the stove timer went off. Dinnertime... and not a moment too soon.

Labels:

couponing,

frugality,

hair care,

hair color,

home hair cut,

timer

Saturday, February 19, 2011

The Tri-level Emergency Fund

Here's something I've been doing for some time and just saw an article on the Frugal Dad blog that showed me that a lot of others are doing it too. It is called the tri-level emergency fund and its a great idea.

Basically, you have three emergency funds. One within arms reach, the second fairly close by and the third one for the long-term.

The first would be a cash stash at home for when you need money on the spot and can't run to an ATM, power is out, etc. I've been doing this for years just for piece of mind. Frugal Dad suggests stashing about $500 or so. I generally like to keep $200-$500 in what I call my piggy bank account...my secret cash stash. And, no, I'm not telling you where it is!

The second is a local checking account where you can write checks for those things that happen that aren't always budgeted for such as busticated something or another or some kind of budget busting situation. This is the curve-ball or Murphy fund for when shit happens and things that pop up once or twice a year that would blow your normal monthly budget, such as car repairs, home repairs, speeding tickets... that type of thing. Dave Ramsey would probably call this the baby emergency fund so let's put about $1,000 there ($500 if your income is under $20K). The way I personally work this account is that I have a savings account at the same bank where I have my checking account. I transfer a set amount from my checking account every month to take it out of my normal spending allowance. Since they are both at the same bank, I can transfer money back and forth as needed online to take care of life's little emergencies. Ideally, I would like to see about $2-3k here as a more liquid account. Murphy seems to visit my house often, you see.

The third emergency fund is that real one people talk about where you have several thousand dollars socked away. That's my money market account over at the credit union which I will fund to 3-6 months of expenses after I dig myself out of debt. (I'm still only on baby step 2). Suze Orman says 8 months expenses is the correct amount. Personally, that is really a stretch goal for my situation and I'm sure many others feel that way. It's one of the reasons I can relate more to Dave than Suze. She's more for the yuppy crowd.

Many people put this main emergency fund (#3) into a higher paying online savings account at ING or Ally or a money market account or CD. This is the emergency fund for the big emergencies such as job loss or major illness when you are literally living off your savings so don't touch it for anything less. Life's little curveballs are paid from account #2. Unfortunately, right now I am nowhere near fully-funded in the main emergency fund, but I'm making direct deposits from my paycheck to get it going. I think that when I get it up to $8-10K I will be happy and start investing and working more on college and retirement goals.

I hope this idea of a tri-level emergency fund helps you also. I think it is the one thing that I am personally doing that will help me avoid credit card debt.

Basically, you have three emergency funds. One within arms reach, the second fairly close by and the third one for the long-term.

The first would be a cash stash at home for when you need money on the spot and can't run to an ATM, power is out, etc. I've been doing this for years just for piece of mind. Frugal Dad suggests stashing about $500 or so. I generally like to keep $200-$500 in what I call my piggy bank account...my secret cash stash. And, no, I'm not telling you where it is!

The second is a local checking account where you can write checks for those things that happen that aren't always budgeted for such as busticated something or another or some kind of budget busting situation. This is the curve-ball or Murphy fund for when shit happens and things that pop up once or twice a year that would blow your normal monthly budget, such as car repairs, home repairs, speeding tickets... that type of thing. Dave Ramsey would probably call this the baby emergency fund so let's put about $1,000 there ($500 if your income is under $20K). The way I personally work this account is that I have a savings account at the same bank where I have my checking account. I transfer a set amount from my checking account every month to take it out of my normal spending allowance. Since they are both at the same bank, I can transfer money back and forth as needed online to take care of life's little emergencies. Ideally, I would like to see about $2-3k here as a more liquid account. Murphy seems to visit my house often, you see.

The third emergency fund is that real one people talk about where you have several thousand dollars socked away. That's my money market account over at the credit union which I will fund to 3-6 months of expenses after I dig myself out of debt. (I'm still only on baby step 2). Suze Orman says 8 months expenses is the correct amount. Personally, that is really a stretch goal for my situation and I'm sure many others feel that way. It's one of the reasons I can relate more to Dave than Suze. She's more for the yuppy crowd.

Many people put this main emergency fund (#3) into a higher paying online savings account at ING or Ally or a money market account or CD. This is the emergency fund for the big emergencies such as job loss or major illness when you are literally living off your savings so don't touch it for anything less. Life's little curveballs are paid from account #2. Unfortunately, right now I am nowhere near fully-funded in the main emergency fund, but I'm making direct deposits from my paycheck to get it going. I think that when I get it up to $8-10K I will be happy and start investing and working more on college and retirement goals.

I hope this idea of a tri-level emergency fund helps you also. I think it is the one thing that I am personally doing that will help me avoid credit card debt.

Sunday, February 13, 2011

Helping pay down the National Debt

Hey, guess what I discovered today while working on my taxes. Turbo tax gave me an opportunity to get back part of my refund in savings bonds and gave a link to treasury direct. While surfing the site I noticed that one of the options is to make a payment to the treasury to help pay down the debt. I don't know if you've noticed, but there is a national debt counter on the site here and it is $14 gagillion and something and counting. I think I read somewhere recently that it adds up to over $40,000 per person in America. Now isn't that just dandy the way they spend our money?

Just in case you are looking to help reduce the national debt, here's the link You can pay online with credit card (that is, if you have not had your plasectomy yet) or you can mail them a check.

In a way I'm tempted to help because I love this country and am concerned about my kids future, but it is not a tax deductible donation, so I will continue giving my financial support to organizations that help people with autism or other charities. When our country can balance their budget and act halfway responsible with taxpayer money and make a good faith effort in getting America out of the hole, maybe I'll reconsider. Right now, I don't care to be an enabler.

Just in case you are looking to help reduce the national debt, here's the link You can pay online with credit card (that is, if you have not had your plasectomy yet) or you can mail them a check.

In a way I'm tempted to help because I love this country and am concerned about my kids future, but it is not a tax deductible donation, so I will continue giving my financial support to organizations that help people with autism or other charities. When our country can balance their budget and act halfway responsible with taxpayer money and make a good faith effort in getting America out of the hole, maybe I'll reconsider. Right now, I don't care to be an enabler.

Friday, February 11, 2011

Atlas Shrugged Trailer released today

Yes! My favorite book is finally coming to the big screen on April 15, 2011. The trailer just came out today so check it out. I can't wait. This one is going to be gooooooood!

Visit the Official Atlas Shrugged Movie Web Site!

Visit the Official Atlas Shrugged Movie Web Site!

Tuesday, February 8, 2011

Me and Dave Ramsey: a love/hate thang going on

I am re-reading The Total Money Makeover by Dave Ramsey. I had loaned the book to a friend about a year ago and just got it back. Unfortunately, the book was not read by the friend I loaned it to over all those months. That makes kat sad.

Over the last couple of years I've read and watched a lot about personal finance and Dave is the one that resonates with me. Maybe its because of his distrust of government, maybe its just old-fashioned common sense, maybe its his sense of humor or his insights. I just like the dude and try to tune into his radio program workday afternoons via the internet.

I have my differences with him though but they are not deal breakers. I am not religious and this was a big hurdle for me, but I've gotten so the bible verses don't really bother me much anymore and sometimes even make sense. "The rich will rule over the poor and the borrower is slave to the lender" is from the bible, but it is so so true. I just have to realize that most people are religious and his ministry speaks to them on a different level than they speak to atheists like me.

I am working my snowball in my own way and probably could give it more gazelle intensity. Part of the purpose of writing this blog is to keep myself motivated to get out of debt. I am over 45 so I am not giving up my 401k investments completely while I pay off the credit cards. I pay myself before the credit cards and with my budget so tight, I don't have a lot going to my snowball.

The other thing I do that would have Dave screaming at me is having whole life insurance. I am not in a position to self-insure and I have a special needs kid, so this small policy is my piece of mind and will fund a small special needs trust for him upon my passing. I also have a term policy through work and an additional term policy that is good until I'm 80 years old. Term life insurance always sounds hunky dory and is way less expensive than whole life, but I can't help but feel that I'm betting against myself and I don't like that. My life expectancy is longer than the term policy and I will most likely outlive them. I will most likely be financially responsible for my son in some way all his life and I need insurance past the age of retirement. So now I've got my small whole life policy, term life, and my long-term care policies in place, along with a will and special needs trust. I resisted for a long time doing the will, but then got prepaid legal at work and just took care of my paperwork. I'm glad I finally did. Even if you are like me and don't have a lot of assets, it is good to have your paperwork in order, just in case.

Over the last couple of years I've read and watched a lot about personal finance and Dave is the one that resonates with me. Maybe its because of his distrust of government, maybe its just old-fashioned common sense, maybe its his sense of humor or his insights. I just like the dude and try to tune into his radio program workday afternoons via the internet.

I have my differences with him though but they are not deal breakers. I am not religious and this was a big hurdle for me, but I've gotten so the bible verses don't really bother me much anymore and sometimes even make sense. "The rich will rule over the poor and the borrower is slave to the lender" is from the bible, but it is so so true. I just have to realize that most people are religious and his ministry speaks to them on a different level than they speak to atheists like me.

I am working my snowball in my own way and probably could give it more gazelle intensity. Part of the purpose of writing this blog is to keep myself motivated to get out of debt. I am over 45 so I am not giving up my 401k investments completely while I pay off the credit cards. I pay myself before the credit cards and with my budget so tight, I don't have a lot going to my snowball.

The other thing I do that would have Dave screaming at me is having whole life insurance. I am not in a position to self-insure and I have a special needs kid, so this small policy is my piece of mind and will fund a small special needs trust for him upon my passing. I also have a term policy through work and an additional term policy that is good until I'm 80 years old. Term life insurance always sounds hunky dory and is way less expensive than whole life, but I can't help but feel that I'm betting against myself and I don't like that. My life expectancy is longer than the term policy and I will most likely outlive them. I will most likely be financially responsible for my son in some way all his life and I need insurance past the age of retirement. So now I've got my small whole life policy, term life, and my long-term care policies in place, along with a will and special needs trust. I resisted for a long time doing the will, but then got prepaid legal at work and just took care of my paperwork. I'm glad I finally did. Even if you are like me and don't have a lot of assets, it is good to have your paperwork in order, just in case.

Sunday, February 6, 2011

Grocery shopping today

Today we went to Sam's Club to buy groceries. I am trying very hard to stick to a budget of about $150 a week for groceries. Sam's is the place where you buy things in bulk, but for my piggy family, it goes too fast to feel like we're buying in bulk. Yes, food prices are rising and even our beloved 8 o'clock Colombian coffee that used to be one of the best bargains there went up in price from $11.22 to $11.96 per bag. They say prices are not rising and we have to worry about deflation, but that's a crock. What they don't normally tell you is that the consumer price index does not count food and energy prices in their calculations and that is where the consumers feel it most. At least my family does.

Anyway, today was the first time in at least 10 years where I paid for more than $100 groceries with cash. Let me tell you it was weird. Talk about keeping it real. You are way more aware of your spending when you are counting out that money at the checkout. I am not quite doing the envelope system and I do find that debit card transactions are so much easier to keep track of with online banking. Try paying for things with cash more and you find it more difficult to spend money. And if you are like me and trying to spend less and save more, it will help you avoid some of the impulse spending. Try it next time you go shopping.

Anyway, today was the first time in at least 10 years where I paid for more than $100 groceries with cash. Let me tell you it was weird. Talk about keeping it real. You are way more aware of your spending when you are counting out that money at the checkout. I am not quite doing the envelope system and I do find that debit card transactions are so much easier to keep track of with online banking. Try paying for things with cash more and you find it more difficult to spend money. And if you are like me and trying to spend less and save more, it will help you avoid some of the impulse spending. Try it next time you go shopping.

Saturday, February 5, 2011

Watch Ads for Money & Prizes

I'd like to introduce you to a new opportunity called Varolo. It is sort of like an advertising or marketing research program with a social networking element. You watch and rate ads for cash, credits and chances to win prizes and when you bring others into the program you win if they win... so basically its a win-win!

We're all tired of being bombarded by irrelevant ads; after all, many of us have replaced our radios with MP3 players, we use DVR's to fast-forward over commercials on our TVs, and our magazines and newspaper subscriptions are rapidly being replaced by online news, blogs, and virtual magazines. We've also adopted technologies like pop-up blockers and ad-block browser plugins, all because the ads we're seeing are neither timely nor relevant to our individual interests.

Our society feels that advertisements are a nuisance because they waste our time, aren't usually topical or relevant, and usually disrupt our other activities. As a result, advertisers are frustrated. Varolo was designed to solve the problems and waste associated with advertising. Varolo incents us to watch relevant ads that match our interests in exchange for chances to win huge weekly jackpots and through direct pay, leveraging the social networks they build. Through Varolo, users can also receive exclusive promotions and coupons directly from advertisers. Varolo also offers users a method to donate their time that translates directly into monetary donations to their favorite charities. By making ads relevant for users, and also giving them direct benefits--all while creating real value for consumers and advertisers, we create a true win-win scenario!

How it works

* Varolo is completely, 100% free!

* Fill out your free profile so advertisers can send you ads based on you and your interests.

* Advertisers are paying you to watch ads rather than television networks and other advertising mediums

* Each ad you watch gives you a chance to win a huge weekly jackpot.

* You can build a village of friends you have invited to Varolo and earn money on each ad they watch. Your village consists of your friends, their friends, their friends, and even their friends!

C'mon, take the tour and see how you can watch and rate ads for money and fabulous prizes. Click the banner above.

Snowballing into the New Year

“You can’t spend more than you make, you’re not in Congress!” - Dave Ramsey

At the beginning of every year many of us make “New Year’s Resolutions.” We set personal goals and promise ourselves we will take the necessary steps to improve our life and our situation, for example:

• Lose weight

• Stop smoking

• Get out of debt

I’ve made these resolutions myself. Sometimes they stick and sometimes they don’t. I’m going to talk to you today about trying to get out of debt, why it didn’t work for me before and the debt snowball method that I am using now.

Back in 2009, I decided that I needed to get out of debt. I started reading and watching financial gurus like Suze Orman, David Bach, and Dave Ramsey, and learning all about personal finance. I paid off my credit cards, leaving only my student loan and mortgage. It felt good to be making progress. Unfortunately, it didn’t really stick.

You see, I cheated by refinancing my townhouse and pulling out some extra money to pay down that credit card debt. Hindsight being 20/20 says that it was a horrible idea. My house payment is now nearly half of my monthly take-home pay, and I consider myself lucky at this point not to be underwater or in foreclosure. I guess I learned the hard way that moving money around is not the same as paying off debt.

Sadly, I only stayed out of debt for a few months and then life happened. Car and home repairs, trips, busted computers, etc., etc. and out came the credit card. This is what happens when you don’t have an emergency fund or the discipline to really stop charging (or saying no).