Woo hoo! I just got my tax refund. I know I should strive to owe nothing and not get a refund, but...whatever. It still feels like free money although I know it is not. I also realize that this may be my last four-figure refund as I expect to have less to deduct next year, my youngest will be over 17 and I plan to have my student loan paid off.

I planned carefully on paper where the refund money would go and then Murphy came for a visit and busted my car again, my kid ran up the cell phone bill and my department at work decided to have a big fancy party. This was a slight detour from paying off my school loan in full with the refund money and socking away more in my emergency fund, but it didn't totally derail me. I am so tired of paying for for my past and want to catch up and put more money toward the future. If you are wondering why I put more into my curve ball account instead of my longer term emergency fund, it is because the mechanic said the old car will need a brake job within two months.

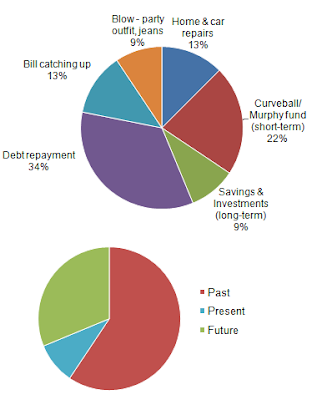

Here's the the breakdown of where the money went. The first chart is where the money went to... and boy did it go fast! For the second pie chart, ideally, it should be allocated at least half to the future. Once my debts are gone, that should become a reality. OK, here's my pie charts showing where this windfall (a bit over a grand) went...

This year, for the first time, I opted to take part of my income tax refund in savings bonds. I had never noticed that option before and have never owned savings bonds. I didn't know how it worked or what the bonds were paying. I found out that it wasn't that easy to find out information on bonds quickly and before TurboTax timed out. I figured I will try it for fifty bucks just to check it out and it would force me to save at least $50 of the refund I had coming.

I just found this article online today that explains it better than what I read on the Treasury site. Read a little more about how this works at wisebread.com Receiving Your Tax Refund in Savings Bonds

No comments:

Post a Comment